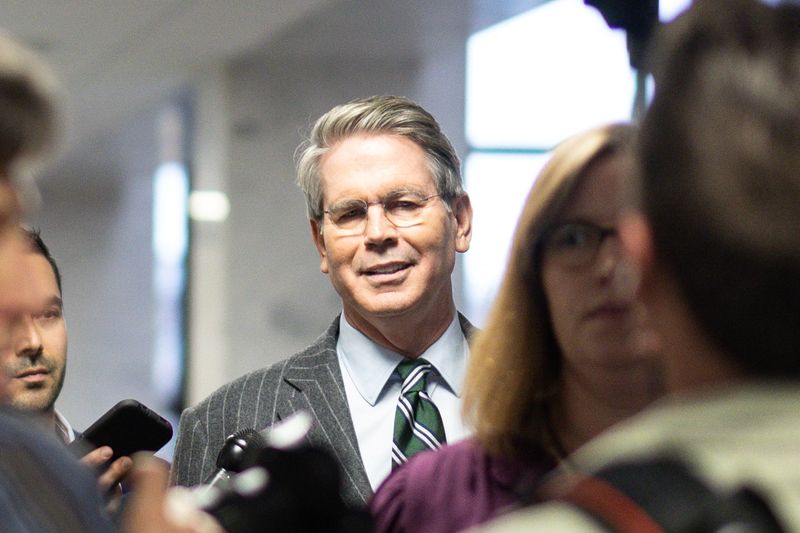

(Reuters) – President Donald J. Trump’s pick for Treasury secretary, Scott Bessent, plans to divest from several funds, trusts and investments in preparation for his new role, The New York Times (NYSE:) reported on Saturday.

In a letter to the Treasury Department’s ethics office, the money manager outlined steps he would take to “avoid any real or apparent conflict of interest if I am confirmed for the position of Secretary of the Treasury Department, ” the report. added.

He also said he would close Key Square Capital Management, the investment firm he founded, and resign from his Bessent-Freeman Family Foundation and from Rockefeller University, where he had been chairman of the investment committee, the Times said. .

A spokeswoman for Bessent declined to comment.

Trump nominated Bessent on Nov. 23. Reuters has not seen the document cited by the Times, but previously reported that a source said that if he works in the new administration, Key Square could be cut, sold , or put in “sleep mode.”

On Friday, Trump repeated the financial arrangements he made during his first term, handing day-to-day management of his multi-billion-dollar real estate, hotel, golf, media and licensing portfolio to his children. when he entered the White House.