Earning money to Charles Payne discusses Wall Street’s interpretation of President Donald Trumps’s rates.

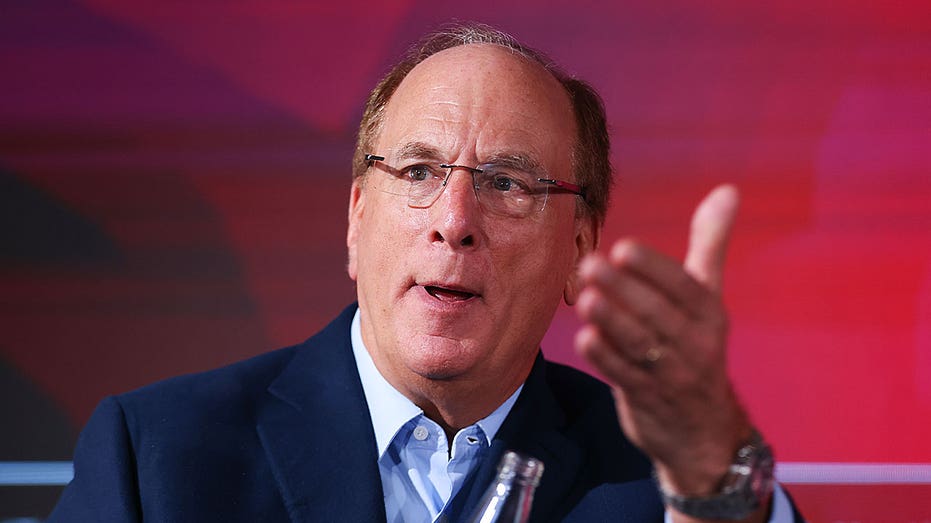

CEO of Blackrock, Larry Fink He said that the securities market could decrease another 20% in the midst of the uncertainty about President Donald Trump’s rates and that delegated directors tell him that they think the United States economy is probably in a recession.

“Most of the CEOs with whom I speak would say we are Probably in a recession Right now, “Fink told the New York Economic Club on Monday. The rates are expected to make a wide variety of more expensive products, aggravating the inflationary pressures that have been persistent in recent months.

Despite the crisis in the market, Fink said that weakness creates a long -term purchase opportunity despite the potential of more falls.

“I would say in the long run, this is more than a purchase opportunity than a sales opportunity. This does not mean that we cannot fall by 20% more here,” said Fink.

Blackrock’s CEO Larry Fink said that the CEOs speaking to think that the United States have already entered a recession. (Hollie Adams / Bloomberg through Getty Images / Getty Images)

“The economy is weakening as we speak,” said Fink, adding that the economy slows down in the coming months Inflation is likely to be high.

Given his concern about inflation, Fink said he sees no chance that the Federal reservation It will reduce interest rates four or five times this year due to the perspectives of inflation, which could become more difficult as the tariffs come into force and foreign governments represent themselves.

The Trump’s Tariff ad on April 2 caused markets to immerse In the following days, with the industrial average of Dow Jones, S&P 500 and Nasdaq Composite, more than 9% were reduced in the last five days of negotiation and more than 10% over the last month.

Blackrock made an intention to buy two ports on the Panama channel at a company based in Hong Kong. (Justin Sullivan / Getty Images / Getty Images)

Fink also discussed Blackrock offer To buy a couple of ports on the Panama Canal along with dozens of other Hong Kong firm, CK Hutchison.

He said that the agreement is over nine months more than the Chinese government regulatory review, which has been critical of the transaction, which would see that Blackrock acquired the ports of Balboa and Cristobal on the Panama Channel plus 43 ports from 23 other countries.

| Dial | Safety | Ultimate | Shift | Change % |

|---|---|---|---|---|

| Blk | BlackRock Inc. | 818.12 | -4.50 |

-0.55% |

Get Fox Business during clicking here

The agreement has a value of $ 22.8 billion and companies emphasized that the agreement was purely commercial in the midst of the geopolitical concerns of China investments At the facilities of the Panama Canal.

Reuters contributed to this report.