BBC Verification

Getty Images

Getty ImagesU.S. President Donald Trump imposed a 10% tariff on goods in most countries imported into the U.S., and his so-called “worst criminal” has higher interest rates.

But how exactly do these tariffs impose import taxes? BBC verification has been studying the calculations behind numbers.

What is calculation?

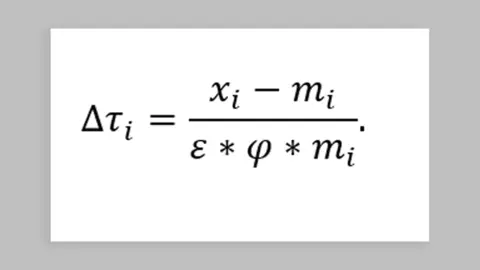

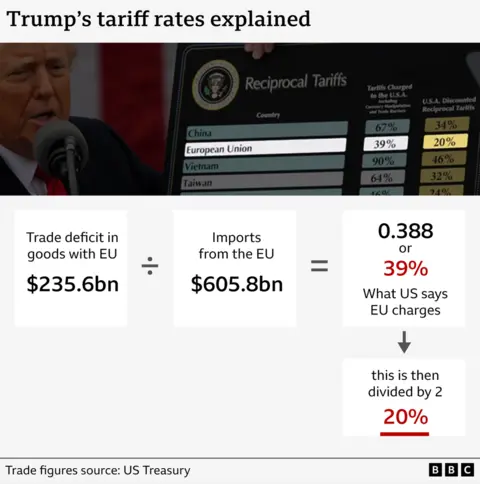

White House

White HouseHowever, the actual exercise comes down to simple math: compare the U.S. trade deficit with a particular country, divide by the total goods imported from that country, and then divide that number by two.

A trade deficit occurs when one country buys (imports) more physical products (imports) than sells (exports) from other countries.

For example, the United States buys far more goods from China than they sell to them – the commodity deficit is $2.95 billion. Its total purchases from China amounted to US$440 billion.

Dividing 295 by 440 makes you reach 67%, then divide it by two and round. Therefore, the tariffs imposed on China are 34%.

Similarly, when it applies to the EU, the White House’s formula imposes a 20% tariff.

Are Trump’s tariffs “reciprocal”?

Many commentators pointed out that these tariffs are not reciprocal.

Reciprocity means they are based on countries that have been charged in the form of current relevant taxes and in countries with non-tariff barriers (e.g. regulations that raise costs).

However, the official White House methodology clearly shows that they have not yet calculated for all countries that impose tariffs.

Instead, tariff rates are calculated based on the U.S. commodity trade deficit in each country.

Trump violated the formula to impose tariffs on countries that buy more goods from the United States rather than sell them.

For example, the United States has not yet entered into a commodity trade deficit with the United Kingdom. However, the UK suffered a 10% tariff.

In total, more than 100 countries have covered the new tariff system.

“Broader Impact”

Trump believes that the United States has encountered bad deals in global trade. He believes other countries have flooded the U.S. market with cheap goods, which hurts U.S. companies and fees. At the same time, these countries are raising barriers that make our products poorly compete abroad.

So, by using tariffs to eliminate the trade deficit, Trump hopes to restore U.S. manufacturing and protection efforts.

Reuters

ReutersBut will this new tariff system achieve the expected results?

BBC Verification has spoken with many economists. The overwhelming view is that while tariffs may reduce the commodity deficit between the United States and countries, they will not reduce the overall deficit between the United States and the rest of the world.

“Yes, this will reduce the bilateral trade deficit between the United States and these countries. However, there are obviously many broader implications in the calculation.”

That’s because the overall deficit in the United States is not driven just by trade barriers, but by how the U.S. economy works.

On the one hand, Americans spend and invest more than they earn, and the gap means that the United States buys more from the world. So, as long as it continues, the United States may continue to deficit despite the increased tariffs from IT global trading partners.

Some trade deficits may also exist for a number of legitimate reasons – not only due to tariffs. For example, it is easier or cheaper to buy food from other countries’ climates.

“The formula is designed to reversely rationalize tariffs on countries where the U.S. is experiencing a trade deficit. There is no economic reason to do so, which will cost the global economy a lot.”