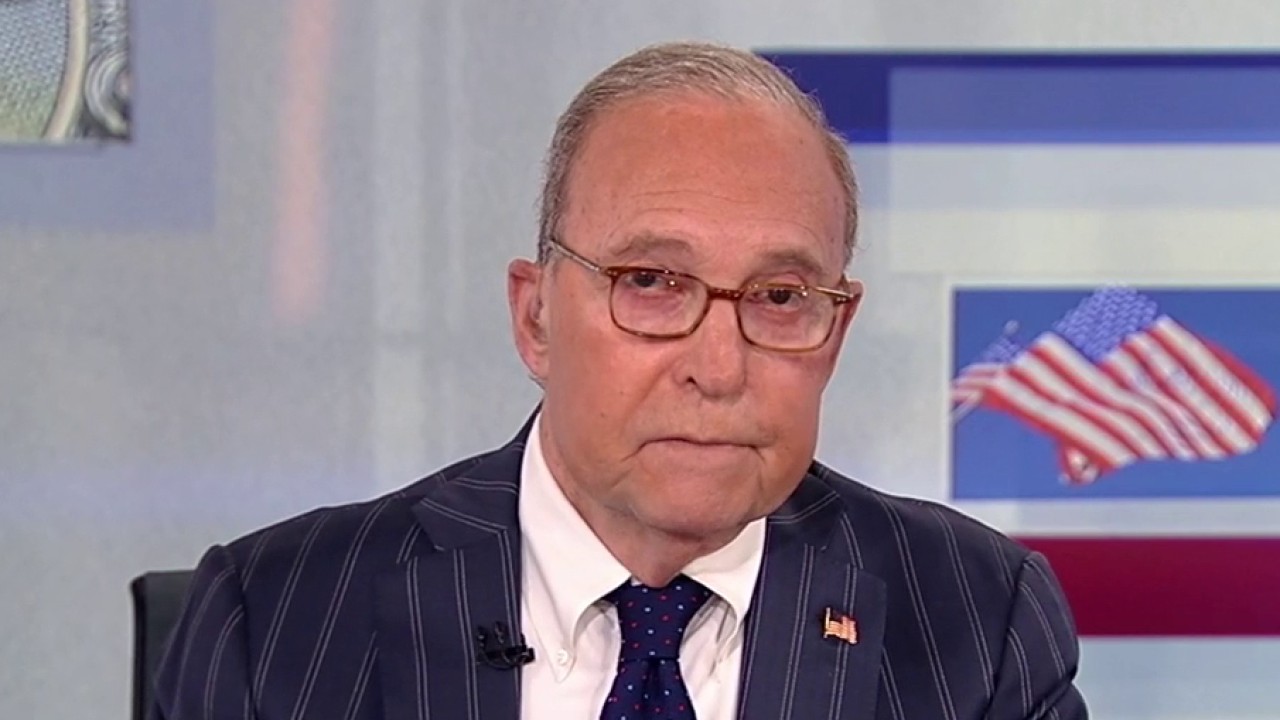

FOX Business host Larry Kudlow discusses Republican unity heading into 2025 on “Kudlow.”

Trump needs a big, beautiful coalition to pass a big, beautiful reconciliation bill and that’s what the riff is about. There are a number of important reasons for President Trump to go ahead with his one big, beautiful bill in his meeting tonight with Republican senators, but one almost overlooked reason is the diversity of Republicans in the House, where really any meaningful legislation requires a coalition. Here’s speaker Mike Johnson making the point today:

MIKE JOHNSON: “I think it makes more sense in terms of what we need to accomplish. The House is a very diverse conference. The House Republican Conference is broad and has over 200 people with many different views and dynamics in their home districts and so you’ll take that into account and we’ll So I think if you put all the measures in one package and it will greatly increase the probability of achieving all your goals we’ve focused on the strategy of a invoice”.

TENS OF THOUSANDS OF AMAZON WORKERS RETURN TO WORK IN PERSON IN WASHINGTON

Sen. Mike Crapo, R-Idaho, unpacks the tax code and proposed tariffs under President-elect Donald Trump on “Kudlow.”

I can think of at least four key groups whose votes will be needed to pass President Trump’s agenda. One is the group of tax cuts in favor of supply growth. Second, those who want sufficient resources to close the border. Thirdly, those who will insist on budget cut compensations for PAYGO to balance it expense increases and fourth are the heavy-duty defense hawks.

Personally, I’m in favor of all four, but not everyone in the House GOP conference is. What Speaker Mike Johnson says is that the strategy of a bill is the only way to combine all these different interests. It’s important to note that the PAYGO budget cutters will play a crucial role in any deliberations, whether on this bill or the next ten, and rightly so. There has only been blatant disdain for excessive budget spending, in both political parties. This one party deficit and the debt bonanza must stop.

That said, delaying tax cuts will delay the blue collar boom. Delaying tax cuts will disappoint President Trump’s new working-class Republican coalition. Delaying the tax cuts will delay the next real boom in the middle class, which will hurt Republicans in the 2026 midterms. Most of the tax cut work is just to extend the first tax cuts mandate of Mr. trump There is nothing terribly complicated about it.

Trump’s plan for a 15% corporate tax rate, along with tax-free cash tips and overtime pay, are important economic growth measures, but there’s nothing difficult about them either. Furthermore, this Trumpian combination of supply-side policies (tax cuts, deregulation, and more energy production) will eventually end Bidenflation. Meanwhile, the House has already approved HR1 for the energy reform and HR2 for the closing of borders.

GET THE FOX BUSINESS ANYWHERE CLICK HERE

As for various thumbtacks, if some of our Republican friends want to double the SAL deduction, well, that’s small beer. Just give it to them.

Finally, contrary to some fake news, Mr. Trump is seeking a broad-based universal tariff, which could to pay for lots of tax cuts, and then some. The United States imports about $5 trillion a year, and 10% of that is worth $500 billion. That comes with a lot of tax cuts, and other priorities as well. In addition to the need for coalition thinking, people should think about the tariff potential to finance these tax cuts. Trust me, it’s never far from President Trump’s mind. This is the riff.

This article is adapted from Larry Kudlow’s opening comment in the January 8, 2025 edition of “Kudlow”.