Business Reporter

Alami

AlamiThe Nike Air Jordan 1 is in some ways an iconic American coach. This is a popular line for a large American brand, created for local basketball legend Michael Jordan forty years ago.

But while Nike sells most of its products in the United States, almost all of its coaches are made in Asia – The region targeted by President Donald Trump’s tariffs Salvo targeted foreign countries, accusing “deprived” Americans.

Nike’s shares fell 14% the day after the tariffs were announced, fearing their impact on the company’s supply chain.

So, what does this mean for Nike coaches’ price?

It depends on how much more expensive Nike decides to transfer it to customers and how long they think the tariffs will actually take.

“Competitive Industry”

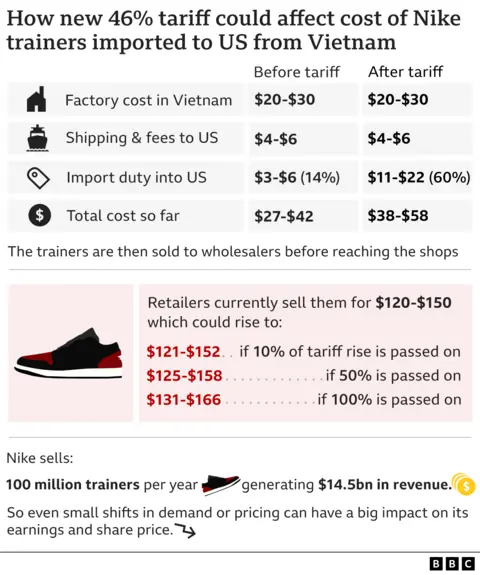

Goods from Vietnam, Indonesia and China face some of the heaviest import taxes in the United States – between 32% and 54%.

Hopefully, Trump may be willing to negotiate lowering these rates. On Friday, he said he had a “very productive” call with Vietnamese leaders to help Nike stock recover some ground after a steep fall on Thursday.

But most analysts believe that the company’s prices must rise.

Swiss Bank UBS estimates that prices from Vietnam will increase by 10% to 12% – Nike makes half of the shoes.

Meanwhile, Indonesia and China account for almost all the balance of coach production.

“Our view is that given the broader scope of the tariff list, the industry will realize that there is no other way to mitigate the medium-term impact other than raising prices,” UBS analyst Jay Sole said in a note.

David Swartz, senior equity analyst at Morningstar, agreed that a price increase might be possible, but said any significant gains would reduce demand.

“It’s a very competitive industry. My guess is that Nike has a hard time raising the price by more than 10-15%. I don’t think it’s offsetting most of the tariffs,” he said.

Many other Western brands like H&M, Adidas, Gap and Lululemon will face the same dilemma.

Nike has faced the bottom line.

In the most recent fiscal year, it has sold about US$5.1 billion (£39.6 billion). The cost of manufacturing products, including transportation, third-party profits and warehouse expenses, consumes only about 55% of revenue, giving its healthy gross margins over 40%.

However, once you increase the cost of other business operations, this profit will disappear. For example, one-third of its revenue is consumed through sales and administrative expenses.

Nike’s margin has shrunk to about 11% when you consider interest and taxes.

This is in all products, because their different items don’t cost separately.

Rahul Cee, who built the trainer review website, said Nike has other ways to keep retail prices low.

Mr Cee, who has trained as a footwear designer and works at Nike and Vans in India, said one approach could be to relegate the skill level of the coach.

“So, instead of using high-performance midsole foam and structure, we must stick to injection molded EVA (ethylene ethylene vinyl ester).”

Another option is to refresh the design cycle every three to four years, rather than refreshing the new design every three years.

Reuters

ReutersThings may change soon

Simeon Siegel, managing director of BMO Capital Markets, said most companies view Wednesday’s announcement as “staying away from the final conclusion.”

“I don’t think many people think that these numbers are still carved on stones,” he said.

In theory, Nike is a big brand and it should be able to push the price up without reaching sales, but he added: “They have a problem now and is it a problem if they have it in the product product?”

Even before the announcement, Nike faced a sluggish sales slump, curbing its ability to fully price shoes.

Finance chief Matthew Friend also used tariffs as an example of the development that impacted consumer confidence.

Nike relies heavily on U.S. sales, and the market contributes about $21.5 billion in sales – almost everything sold in North America’s largest market.

Sheng Lu, a professor of fashion and clothing studies at the University of Delaware, said that American sentiment directly affects Nike’s demand because it directly affects the demand for footwear.

But eventually he said the company might be forced to transfer the cost of taxes to consumers.

“If the tariff war persists, Nike is likely to raise prices. Brands cannot absorb 30% to 50% of the procurement costs.”

“How the U.S. trading partners respond to reciprocity tariff policies will also have a significant impact,” he added.

China has hit it with 34% tariffs.

Part of the reason behind Trump’s tariff policy is because he wants more companies to produce their goods in the United States.

But professors LU didn’t see Nike or other companies, who would soon be “due to the complexity involved in footwear manufacturing” and would soon be greatly reshaping their supply chains.

This includes the time it takes to consider a range of factors (quality, cost, market speed, and various social and environmental compliance risks” when deciding where to source products.

Matt Powers of the Powers Advisory Group said the lack of American textile mills would make it “hard and expensive (Nike) to transfer production back to the United States.”

“This transition will take years and requires a lot of investment,” Mr. Powers added.

Nike did not respond to a request for comment from BBC this article.

We also contacted 30 suppliers in Asia, but did not respond.

Other reports by Natalie Sherman in New York